Inside The 'One Big, Beautiful Tax Bill': What It Could Mean For You

Key Takeaways

Higher Deductions for Individuals and Families: The standard deduction would rise to $16,000 for single filers and $32,000 for joint filers, with an additional $4,000 boost for seniors.

Expanded Tax Breaks for Small Businesses and Families: The Qualified Business Income (QBI) deduction increases to 23%, though it phases out for high earners; the Child Tax Credit would increase to $2,500.

Broader Use of 529 Plans and Estate Tax Relief: 529 plans would now cover curriculum, professional fees, and K–12 support; the estate tax exemption would be locked in at $15 million per person, adjusted for inflation.

On May 22, 2025, the Republican-controlled House of Representatives passed what’s officially titled the "One Big Beautiful Bill Act", a sweeping tax and spending package that reflects key elements of former President Trump’s economic agenda. While it still faces debate in the Senate, the bill, if enacted, would usher in some of the most significant changes to the U.S. tax code since the 2017 Tax Cuts and Jobs Act.

At its core, the bill seeks to extend and expand many of the tax breaks that were originally set to expire at the end of 2025, while adding new benefits targeted at seniors, small business owners, and families. Here’s a closer look at what’s inside and what it could mean for your financial future.

A Larger Standard Deduction and Added Relief for Seniors

One of the most immediate changes would be an increase in the standard deduction. For single filers, the deduction would rise by $1,000, bringing it to $16,000. Married couples filing jointly would see their deduction increase to $32,000. Seniors would receive even more relief through a temporary $4,000 boost to their standard deduction. The bill also proposes exempting overtime and tips from federal income tax for older Americans, a targeted measure aimed at reducing the tax burden on those working past retirement age.

A Win for Small Business Owners and Entrepreneurs

In a move to encourage entrepreneurship and investment in small businesses, the bill would permanently raise the Qualified Business Income (QBI) deduction from 20% to 23%. However, this more generous deduction would come with new income limits, phasing out for individuals with taxable income over $400,000 and joint filers over $500,000. For eligible filers, this change would allow nearly a quarter of qualifying business income to remain untaxed, boosting after-tax profitability and encouraging reinvestment.

Support for Families with Children

Families with children would also benefit. The Child Tax Credit would increase from $2,000 to $2,500 per qualifying child and remain at that level through 2028. This modest increase aims to offer additional relief during the critical years of child-rearing, while preserving some of the expanded benefits temporarily introduced during the pandemic.

The bill also significantly broadens the scope of 529 education savings plans. Beyond traditional college-related expenses, families could now use 529 funds for K-12 tutoring, textbooks, standardized test preparation, curriculum, professional licensing fees, and even other professional development expenses. This gives account holders much more flexibility in how they support lifelong learning or career transitions.

Relief for High-Tax States and Legacy Planning

The long-debated cap on the State and Local Tax (SALT) deduction would see a dramatic adjustment under the proposed legislation. The current $10,000 cap would increase to $40,000, offering meaningful relief to residents of high-tax states such as New York, California, and New Jersey. This change could significantly reduce the federal tax liability of higher-income earners in those regions.

Estate planning would also be reshaped. The federal estate tax exemption, which had been scheduled to revert in 2026, would instead be locked in permanently at $15 million per individual (or $30 million for married couples), adjusted for inflation. This move would allow for more efficient wealth transfers across generations and could reduce the urgency around many estate planning strategies currently in place.

Additional Changes and Budgetary Considerations

The bill includes several other noteworthy provisions, such as a reduction in the proposed remittance tax rate from 5% to 3.5% and the introduction of a new tiered excise tax on private foundations based on their asset size. It also permanently repeals the personal exemption, streamlining parts of the tax code while eliminating a deduction that previously benefited certain households.

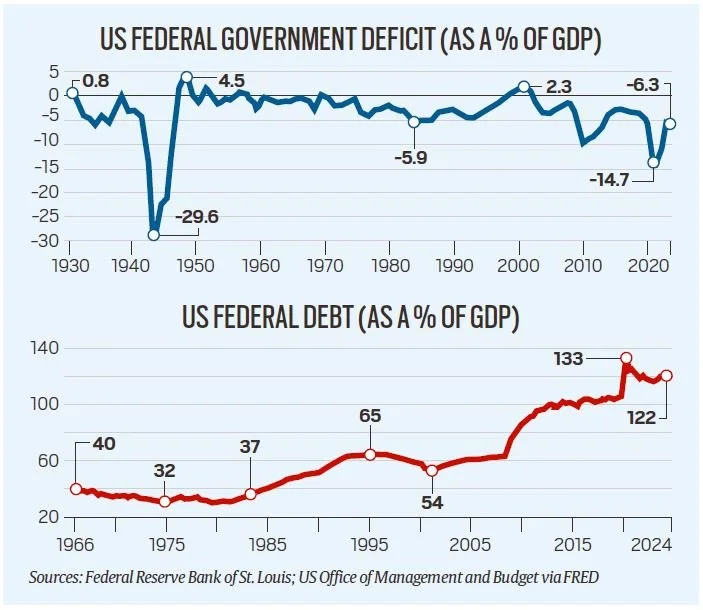

However, the bill comes with a significant fiscal cost. According to the Congressional Budget Office, its passage could increase the federal deficit by approximately $3.8 trillion over the next decade. Critics argue that the legislation disproportionately benefits high-income individuals and corporations, while potentially paving the way for future cuts to essential programs like Medicaid and the Supplemental Nutrition Assistance Program (SNAP).

What Comes Next?

If passed by the Senate and signed into law, this legislation could affect nearly every facet of personal and business tax planning, from how you save for education, to how you manage your retirement income, to how you prepare to transfer wealth to the next generation.

Whether you’re a small business owner evaluating your deductions, a retiree managing taxable income, or a parent planning your children’s future education, these potential changes warrant close attention. At Rimac, we’re committed to helping clients assess how these legislative changes may affect their broader financial goals and investment strategies.

As an independent, fiduciary firm, we offer truly comprehensive advice that’s objective, conflict-free, and always aligned with our clients’ best interest. To get started, schedule a Free Strategy Session with our team today.

This content is for informational purposes only and should not be considered financial or investment advice. Please consult with a qualified financial professional regarding your unique situation. Past performance does not guarantee future results. Investments involve risk, including the potential loss of principal. This is not a solicitation to buy or sell securities.

Connect with Us Today

Schedule a free 30-minute consultation call. We’ll learn more about your priorities and ensure we can answer all of your questions.